Accounting and finance outsourcing in California

We handle everything for you!

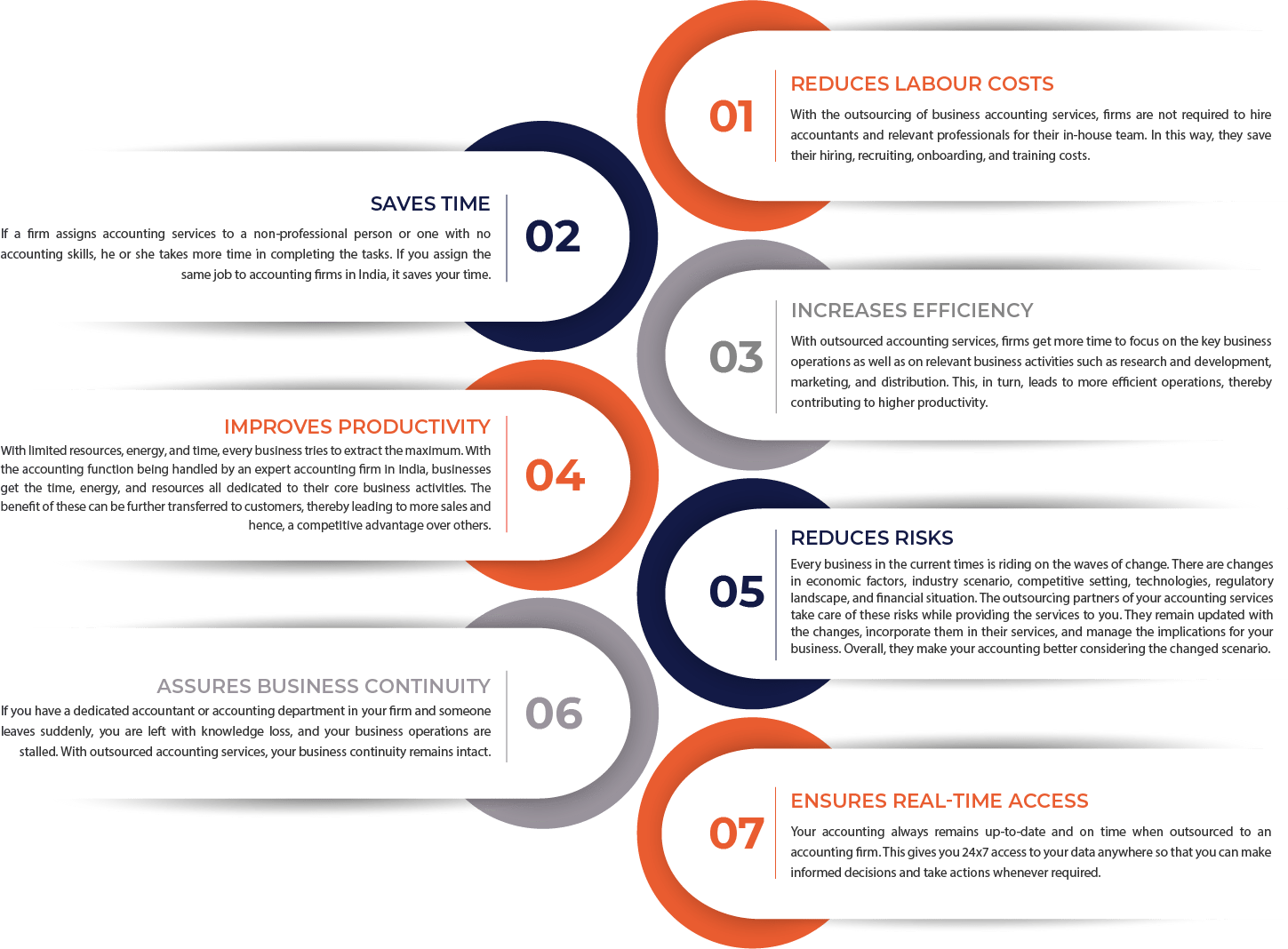

The outsourcing of finance is a movement in development in California following the web. Accounting redistribution is usually done to lower costs, improve efficiency and gain entrance to expertise in a technological area. As companies grow in size and complexness, they also have to concentrate on their center abilities and outsource everything else. Regardless, it is not forever an easy method to outsource analysis. It can be difficult to find a suitable employee that you can trust with your finance team’s data and control.

In this report, We will protect some of the essential topics that help you to outsource your accounting needs. We comprehend the dissimilarities between employing an accountant vs. employing an outsourcer and what that suggests for control and data protection. Successful outsourced bookkeeping bears time to understand your business to provide a private or professional service. If you’re looking for a part-time or full-time outsourced accountant, You might be wondering if outsourcing accounting is right for the business. Good news: accounting and finance outsourcing could be an excellent solution for your company’s requirements. It’s important to make sure that any accounting outsourcing knows of small to medium-sized businesses.

Accounting and finance outsourcing in California

The outsourcing of finance is an activity in development in California following the web. Accounting redistribution is often done to decrease costs, enhance efficiency and gain entrance to expertise in a technical area. As companies grow in size and complexity, they also have to concentrate on their core abilities and outsource everything else. However, it is not always an uncomplicated method to outsource accounting. It can be difficult to find a suitable employee that you can trust with your finance team’s data and control.

In this article, we will elaborate on some of the key cases to help you outsource your accounting requirements. We understand the dissimilarities between hiring an accountant vs. hiring an outsourcer and what that means for managing and data security

- Successful outsourced bookkeeping takes time to understand your company to deliver a private or professional service. If you’re looking for a part-time or full-time outsourced accountant, you might be wondering if outsourcing accounting is right for the business. Good news: accounting and finance outsourcing could be an excellent solution for your business’s needs.

- It’s essential to make sure that any accounting outsourcing has experience with small to medium-sized enterprises.

Accounting outsourcing in California

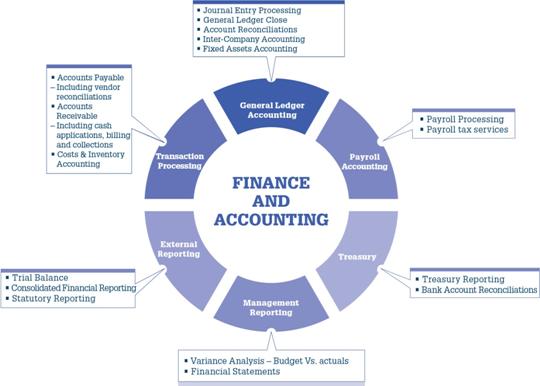

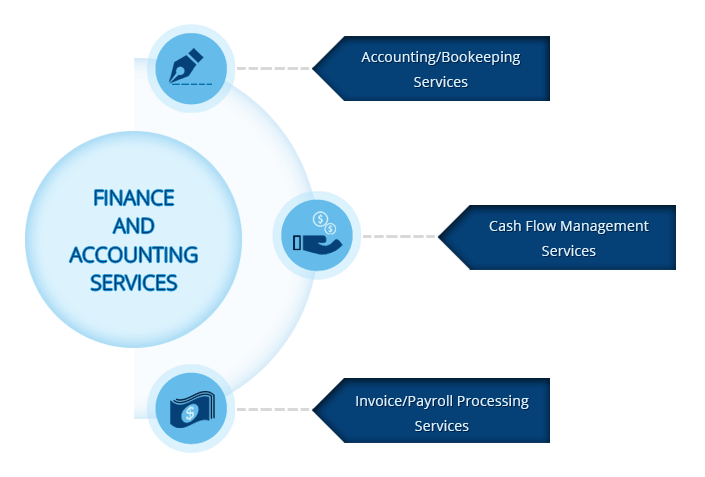

Finance outsourcing is a growing craze in California as a result of the internet. This has created it more comfortable for companies to find dependable, top-quality analysis services at low prices. Accountants are specialists in suspending a company’s economic statements and registering the success of the company. They work with tax experts who support and guide people and firms through finishing their income tax filings. And It’s also registering their taxes to the government. A good accountant can deliver various services associated with taxation, audit, accounts receivables, payroll management, corporate finance, and more. By outsourcing accounting services in California, businesses will include entrance to accounting professionals who can recommend them industry best practices. It studies new possibilities that would help their balance sheet or help them work cash flow.

Outsourcing accounting work to an authorized party can help businesses save time and money. They can develop a business without having to invest heavily in people and setup while providing they have the proper direction. This is an important advantage for small businesses that don’t have the resources or knowledge to manage their accounting.

Accounting outsourcing in California is a state of outsourcing that concerns acquiring an accountancy firm to deliver specific services. It serves specific accounting tasks (taxation, financial statements, bookkeeping, etc.) for a business. The terms “accounting outsourcers” are frequently used interchangeably, but there are important differences between the two, and analysis firms will generally offer a range of accounting services such as taxation and auditing. Outsourcing companies generally only offer one or two types of accounting services. It will hire to deliver those services for clients on an enduring basis.

Latest News

The firm is made up of a pack of highly skilled professionals who spends a lot of awareness on the small segments. With years of knowledge, our team keeps your examining and functioning beautifully.

The company is made up of a group of highly skilled gardening landscaping professionals who pay a lot of attention to the small details. With years of experience, our staff keeps your looking and functioning beautifully.

Accounting and finance outsourcing in California

The outsourcing of finance is a craze in growth in California following the web. Accounting redistribution is frequently done to decrease costs, enhance efficiency and gain credentials to expertise in a technological area. As companies increase in size and complexness, they also have to concentrate on their center abilities and outsource everything else. However, it is not constantly an easy method to outsource accounting. It can be difficult to find a suitable employee that you can depend on your finance team’s data and handle.

In this article, we will cover some of the key subjects to help you outsource your accounting requirements. We understand the dissimilarities between hiring an accountant vs. hiring an outsourcer and what that means for control and data safety

- .Successful outsourced bookkeeping bears time to understand your firm to deliver a private or professional service. If you’re looking for a part-time or full-time outsourced accountant, you might be wondering if outsourcing accounting is good for the company. Good news: accounting and finance outsourcing could be an excellent solution for your company’s requirements.

- It’s crucial to make sure that any accounting outsourcing has experience with small to medium-sized firms

Accounting outsourcing in California

Finance outsourcing is a growing craze in California as a result of the internet. This has made it more comfortable for companies to find trustworthy, top-quality accounting services at low prices.

- Accountants are specialists in balancing a company’s financial accounts and reporting on the success of the business. They perform with tax experts who assist and guide individuals and companies through finishing their income tax filings. And It’s also informing their tariffs to the government.

- The right accountant can deliver various benefits related to taxation, audit, accounts receivables, payroll management, corporate finance, and more.

- outsourcing accounting services in California, businesses will have entrance to accounting professionals who can recommend them industry best practices. It researches new opportunities that would benefit their balance sheet or help them handle the cash flow.

Outsourcing accounting appointments to an authorized firm can help firms save time and money. They can develop a business without having to support heavily people and design while ensuring they have the proper management. This is a vital advantage for small businesses that don’t have the resources or knowledge to operate their accounting.

Accounting outsourcing in California is a setup of outsourcing that concerns acquiring an accountancy firm to provide detailed services. It serves typical accounting tasks (taxation, financial statements, bookkeeping, etc.) for a business. The terms “accounting outsourcers” are often used interchangeably, but there are important dissimilarities between the two, and accounting firms will generally offer a field of accounting services such as taxation and auditing. Outsourcing companies generally only deliver one or two types of accounting services. It will contract to provide those services for clients continuously.

Bookkeeping and accounting outsourcing in California

Bookkeeping is the process of registering financial transactions and then translating them in a way that can be investigated to resolve the financial status of a firm. It is also often guided to as accounting.

The following will deliver an intro to bookkeeping outsourcing in California:-

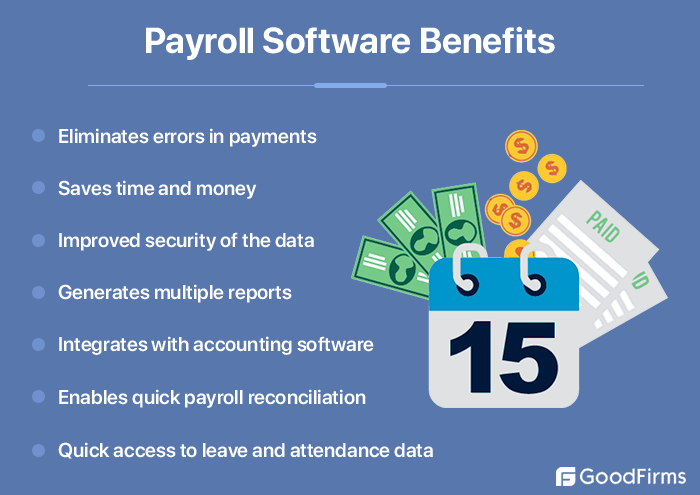

Bookkeeping outsourcing services in California are very famous among small business proprietors. These services are usually more paying than employing bookkeepers on a full-time basis. Outsourcing your bookkeeping can even give you more time to focus on your center firm’s activities. Bookkeeping outsourcing in California is a growing craze. This is because many firms are examining methods to save time and money. Outsourcing bookkeeping services can support you do this by saving time and money. The most useful part is that bookkeeping outsourcing in California has never been more comfortable with all of the companies that are supplying these services. This means that you don’t have to expend a lot of time exploring for the right company, they are all there waiting for your business!

Bookkeeping services are a fantastic way to save money on your tariffs. Employing a bookkeeper can support you dodge expensive mistakes and make sure you agree with all tax laws. When firms outsource their bookkeeping, they often find that they have more time to concentrate on other aspects of their firm. Outsourcing also delivers a level of consistency, as the outsourced firm has one set of methods for all clients.

Why do firms prefer to outsource their bookkeeping and accounting?

Firms prefer bookkeeping outsourcing because it is more affordable than hiring someone internally whereas, it frees up useful time for the company proprietor or manager. Outsourcing bookkeeping services in California can be a fantastic way to save time and get the job done more efficiently.

Outsourcing bookkeeping services in California can be a fantastic way to save time and get the job done more efficiently because it permits you to concentrate on your firm while someone else manages the day-to-day functions of your finances. The advantages of outsourcing your bookkeeping needs are great, with some of them being:

- A skilled service that will handle your books for you, So you can concentrate on other aspects of your firm

- A service that will do all the job for you, which means you don’t need to expend hours exploring and arranging data

Bookkeeping outsourcing in California is a perfect way to save time and money. It permits you to concentrate on what matters most – your business.

There are many advantages of outsourcing bookkeeping services in California. These contain saving time and money, reduce stress, enhance service grades, and free up your time. Bookkeeping is one of the most vital forms of operating a firm. It can be time-consuming, boring, and frequently used. If you are looking to outsource your bookkeeping tasks to an experienced firm in either issue that can take care of all your bookkeeping requirements then you should look no further than California Bookkeeping Services. Whether you are looking to outsource your whole accounting department or desire service with basic accounting and we will work with you to develop a customized solution that meets your requirements and rankings with you as you grow.

Bookkeeping services

- Payroll processing and reporting

- Sales and use tax reporting

- Bank reconciliations

- Accounts payable processing

- 1099 reporting

Small Business Accounting Services We Offer: –

Accounting outsourcing hub is a leading small business accounting service provider. Our solutions include –

1. Financial Statement Preparation Services

Getting prepared and keeping up with funding information is basic to separated firms. They are controlled by the organization’s movements and show the organization’s financial wellbeing. Reviewing the funding information arrangement saves you this work deep work and allows you to grow your business. Our budget overview planning management cover benefit/misfortune accounts, primary adjusts, and asset reports.

2. Small Business Accounting Services

Hiring a virtual bookkeeper from an accounting outsourcing hub can save your accounting duties resuming along as desired without the added overhead of hiring and maintaining a bookkeeper in-house. We have understanding and skill in working with bookkeeping details of little communities. We work with the most current bookkeeping programming like QuickBooks, NetSuite, Peachtree, Quicken, and Sage. You can choose which programming your firm operates with and we will find a suitable rate for that.

3. General Bookkeeping Services for Small Businesses

Most firm idealists start their personal experiences since they have the significance for their item or administration – accounting is regularly evaluated as a job that should be guaranteed to remain in the firm. We can let you complimentary from this firm and take up all the complex job of holding up with your accounting activities. From basic maintenance of forms to finance handling, charge account, settlement of records, and preparing income producer, we can negotiate with them all.

info@accountingoutsourcehub.com

info@accountingoutsourcehub.com